Continuing with our put sales, I found another good candidate today in T. Rowe Price Group Inc. (TROW). TROW is a publicly owned investment manager. The company had actually come recommended recently in two services to which I subscribe. However, I’d also found it during my own research.

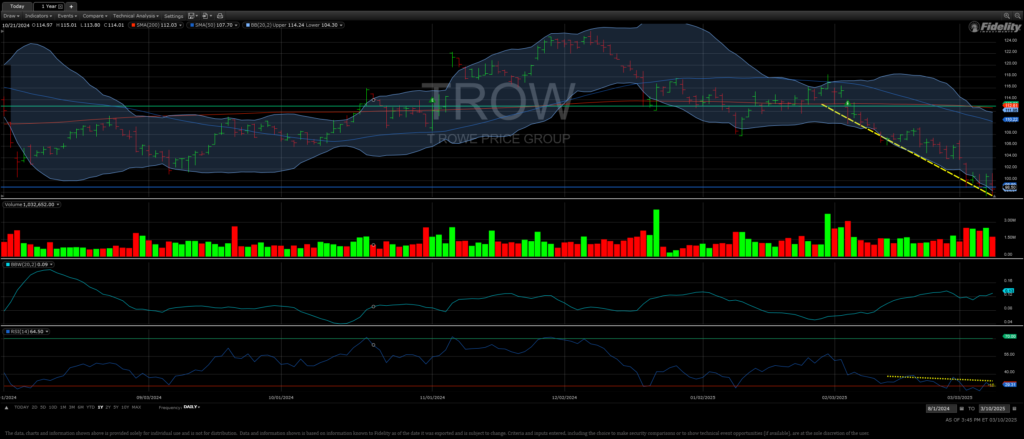

The chart below shows that the price of TROW has been on about a 3-month tumble. This price movement paused briefly and then accelerated about 5 weeks ago (yellow dashed line in the chart.) Also, for the last several sessions, the stock has been at or near the oversold RSI line. Currently it is dropping at or slightly below some long-term established support levels. Today saw another big drop in the share price (along with the rest of the market) so this company seemed a good candidate for an out of the money put.

If we do get assigned at our strike price of $90, this will represent a price that hasn’t been available in the market since October 31, 2023. Sure Dividend has the latest “fair value” price for this company set at $129/share, so a pick up at below $90 would represent a substantial discount. We’ll take our $137 in instant income and move on to other targets if we don’t get assigned.

We sold this contract at a delta of -21.32, or roughly a 21% chance of assignment. If assigned, our dividend yield on cost will be nearly 5-3/4%.

Currently we have our cash covered put reserve up to $19,250, or 38.5% of our initial $50,000 investment. We also have 20% committed to our original outright purchase of shares, for a 58.5% utilization ratio. We need to keep looking for more put candidates and try to bring this closer to 80-90% utilization.

| Option Type | Short Put (STO) |

| Date of Sale | 03/10/2025 |

| Option Sold | -TROW250417P90 |

| Expiration Date | 04/17/2025 |

| Days to Expiration | 38 |

| Number Sold | 1 |

| Premium per Contract | $137.00 |

| Total Premium Received | $137.00 |

| Potential Liability/Cash Put Reserve | $9,000.00 |

| Company Ticker | TROW |

| Stock Price at time of Put sale | $98.15 |

| Strike Price | $90.00 |

| Cost per Share if Assigned | $88.63 |

| Discount to Current Price If Assigned | 9.70% |

| Annual Dividend | $5.08 |

| Dividend Yield at Current Price | 5.18% |

| Dividend Yield on Cost if Assigned | 5.73% |

| Net ROI on Reserve If Not Assigned | 1.40% |

| Annualized ROI on Reserve If Not Assigned | 13.41% |

Outcome – Early Assignment

Despite the option expiring on April 17, we were assigned a day early by some nervous Nelly (sheep) on April 16. Our net cost for the assigned 100 shares was $8,863.68 or $88.64 a share. The stock closed that day at $85.37 and has since recovered above our purchase price. Our initial dividend yield on cost is a nice, respectable 5.73%.