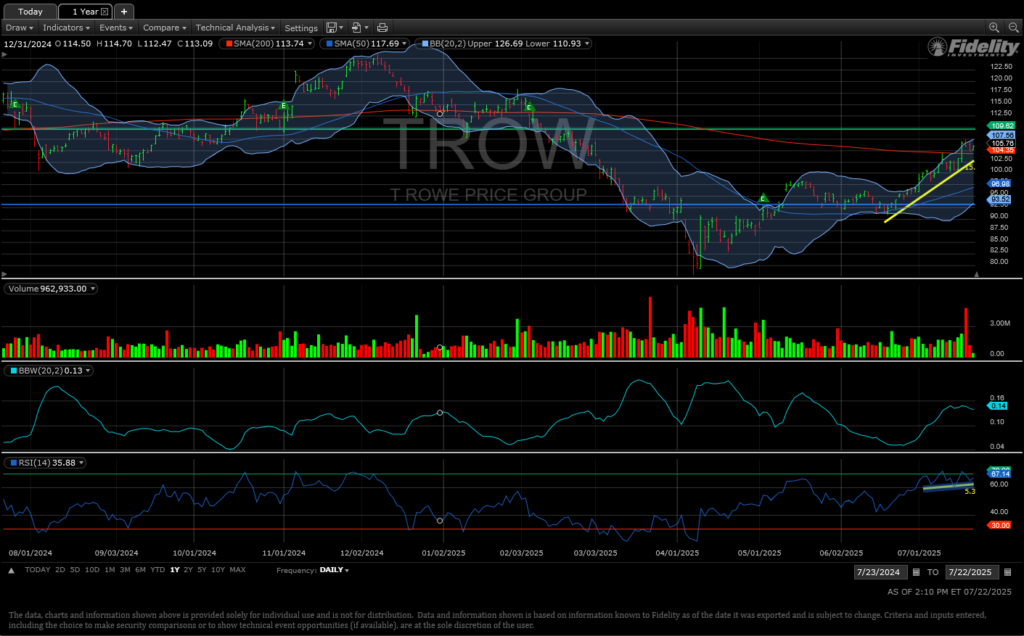

On May 15, 2025, we sold the TROW covered call at the $110 strike price, expiring last Friday, July 18. It’s time to consider renewing this option.

The current chart shows the price nearing overhead resistance, and the RSI has been at or near oversold territory for several weeks. Especially since we are headed into the seasonally week month of August, I don’t believe this stock has much near-term room for price improvement.

Nonetheless, I raised the strike price this time from $110 to $120 to keep the delta down to a reasonably secure .0918. Today offers a nice setup for selling a low delta covered call if you prefer to not be called away, but there’s some nice upside should the call happen.

| Option Type | Short Call (STO) |

| Date of Sale | 07/22/2025 |

| Option Sold | -TROW250919C120 |

| Expiration Date | 09/19/2025 |

| Days to Expiration | 59 |

| Number Sold | 1 |

| Premium per Contract | $41.00 |

| Total Premium Received | $41.00 |

| Company Ticker | TROW |

| Stock Price at time of Call sale | $105.92 |

| Strike Price | $120.00 |

| Annual Dividend | $5.08 |

| Dividend Yield at Current Price | 4.80% |

| Net ROI on Current Price If Not Assigned | 0.39% |

| Annualized ROI on Current Price if Not Assigned | 2.39% |

| Net ROI on Current Price If Assigned | 13.68% |

| Annualized ROI on Current Price if Assigned | 84.63% |