The market has been WILD lately, to say the least. Volatility, and fear, are at peak levels ever since “Liberation Day.” We had a face-melting rally yesterday when Trump announced a 90-day tariff delay. Today, we seem to be giving most of it back.

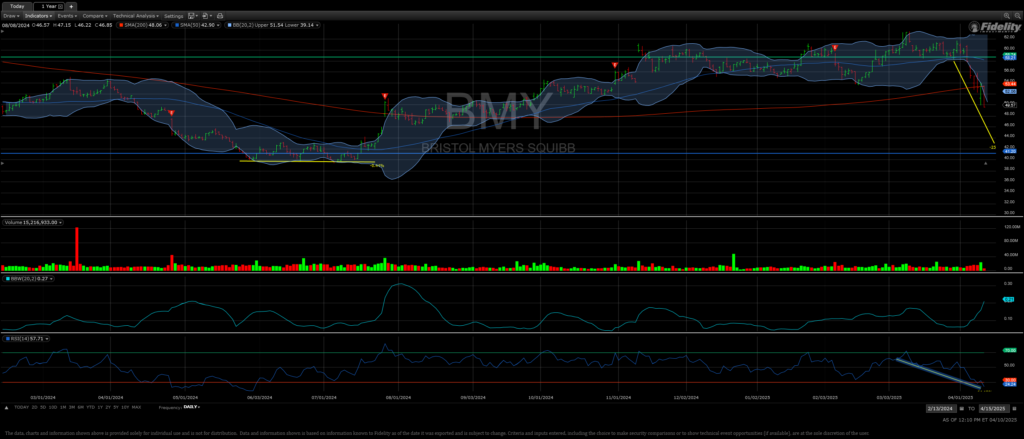

I noticed today that Bristol Meyers Squibb Company (BMY), a pharmaceutical company was down some 6% today, more than any other stock in my watchlist. I also observed on the chart, above, that BMY was deeply oversold, with an RSI of only 24. I observed that the price was in a steep, several days long decline and was headed towards a support area of $41.20.

The good folks at Sure Dividend suggest the fair value price of BMY is $74. With the price at $49.25, this seems like a no-brainer. So I sold to open the May 16, 2025 put at the $43 strike. If we get assigned, this price is nearly the lowest available in the past year.

| Option Type | Short Put (STO) |

| Date of Sale | 04/10/2025 |

| Option Sold | -BMY250516P43 |

| Expiration Date | 05/16/2025 |

| Days to Expiration | 36 |

| Number Sold | 1 |

| Premium per Contract | $114.00 |

| Total Premium Received | $114.00 |

| Potential Liability/Cash Put Reserve | $4,300.00 |

| Company Ticker | BMY |

| Stock Price at time of Put sale | $49.25 |

| Strike Price | $43.00 |

| Cost per Share if Assigned | $41.86 |

| Discount to Current Price If Assigned | 15.01% |

| Annual Dividend | $2.48 |

| Dividend Yield at Current Price | 5.04% |

| Dividend Yield on Cost if Assigned | 5.92% |

| Net ROI on Reserve If Not Assigned | 2.31% |

| Annualized ROI on Reserve If Not Assigned | 23.47% |